Energy Storage Battery Market Outlook: What Does the Demand Look Like in the Coming Years?

The global energy storage battery market1 is booming, but will this growth sustain? Let’s explore the factors driving demand and future projections.

The energy storage battery market1 is projected to grow at a CAGR of 20%2 from 2023 to 2030, driven by renewable energy integration3, grid modernization[^4], and EV adoption[^5], with lithium-ion batteries[^6] dominating the landscape.

The energy storage sector is at a pivotal moment. As someone who’s tracked this industry for years, I’ve seen how batteries evolved from niche applications to becoming the backbone of our clean energy transition. The numbers speak for themselves—but what’s behind this explosive growth? Let’s break it down.

How Energy Storage Batteries Drive the Development of Renewable Energy?

Ever wondered why solar and wind farms are suddenly becoming more reliable? The answer lies in those battery containers sitting quietly beside them.

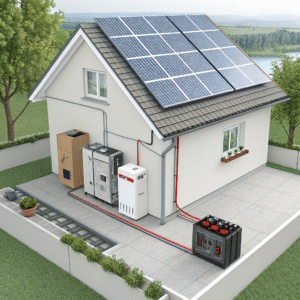

Energy storage batteries enable renewable energy by solving intermittency issues[^7], storing excess generation during peak production, and releasing power during demand spikes or low generation periods.

The Intermittency Challenge and Battery Solutions

When I first visited a solar farm in Arizona, the engineer explained their biggest headache—the sun doesn’t shine at night. Simple, right? But this fundamental truth makes renewables unreliable without storage. Batteries act as a buffer, storing that abundant midday solar energy for evening use.

Here’s how different storage technologies compare in renewable applications:

| Technology | Charge Time | Discharge Duration | Ideal Use Case |

|---|---|---|---|

| Lithium-ion | 1-4 hours | 1-10 hours | Solar/wind smoothing |

| Flow Batteries | 4-10 hours | 10+ hours | Long-duration storage |

| Sodium-sulfur | 6-8 hours | 6-8 hours | Grid-scale applications |

Grid Services Beyond Simple Storage

What fascinates me most is how batteries provide multiple grid services simultaneously. A single battery system can:

- Provide frequency regulation[^8] (responding in milliseconds)

- Shift energy from off-peak to peak times

- Offer voltage support

- Act as backup power during outages

The California ISO market shows how batteries already provide over 2,000MW of fast-frequency response—something impossible with traditional plants.

Economic Benefits and Future Trends

The business case keeps improving. In 2010, a lithium-ion battery system cost about $1,200/kWh. Today? Under $150/kWh. This cost plunge makes storage+renewables competitive with fossil fuels in most markets.

Emerging technologies like solid-state and iron-air batteries[^9] promise even greater breakthroughs. The Department of Energy’s “Long Duration Storage Shot” aims to reduce costs by 90% within the decade—a game-changer for renewable dominance.

Batteries can eliminate renewable energy intermittency. False

While batteries significantly reduce intermittency issues[^7], complete elimination requires a diversified approach including grid management and multiple storage technologies.

Lithium-ion is the only battery technology used with renewables. False

While dominant, other technologies like flow batteries and compressed air energy storage play important roles in renewable integration.

What Are the Latest Breakthroughs in Energy Storage Technology?

The energy storage revolution isn’t coming—it’s already here. But what’s next beyond lithium-ion?

Recent breakthroughs include solid-state batteries[^10] with 2x energy density, iron-air batteries[^9] offering 100-hour storage, and quantum battery concepts that could revolutionize charging speeds, alongside improvements in recycling and sustainability.

Next-Generation Battery Chemistries

Walking through a battery lab last year, I saw prototypes that looked like science fiction. Here’s what’s most exciting:

-

Solid-State Batteries

- Toyota promises commercialization by 2027

- 500+ Wh/kg energy density (vs. 250 for current Li-ion)

- No thermal runaway risk

-

Iron-Air Batteries

- Form Energy’s 100-hour storage system

- Uses cheap, abundant iron

- $20/kWh projected cost (1/10th of lithium-ion)

-

Sodium-Ion Batteries

- CATL’s mass production started in 2023

- No lithium or cobalt needed

- Ideal for stationary storage

Supporting Technologies Making Waves

It’s not just about the batteries themselves. Supporting innovations are equally crucial:

-

AI-powered Battery Management[^11]

Systems that predict cell failures weeks in advance, boosting safety and lifespan. -

Advanced Recycling Techniques

New hydrometallurgical processes recover 95%+ of battery materials versus 50% in traditional methods. -

Grid-Forming Inverters

Allow battery systems to “start” the grid after blackouts—a capability previously limited to spinning turbines.

The Sustainability Imperative

The environmental aspect can’t be ignored. I recently toured a recycling facility where they recover lithium with 99% purity. New regulations like the EU Battery Directive[^12] mandate:

- Minimum recycled content

- Carbon footprint labeling

- Easy disassembly requirements

This push for circularity is transforming how we design batteries from the ground up.

Solid-state batteries are already widely available. False

While promising, commercial solid-state batteries[^10] remain in limited production with full-scale deployment expected post-2025.

All new battery technologies will replace lithium-ion. False

Different technologies will likely coexist, serving various applications based on cost, duration, and performance needs.

What Are the Reasons Behind the Rising Global Demand for Energy Storage Batteries?

Why are countries racing to deploy energy storage at unprecedented scales? The drivers might surprise you.

Global energy storage demand is surging due to renewable energy mandates[^13] (45 countries now have 100% clean energy goals), electric vehicle growth (expected 145 million EVs by 2030), and grid resilience[^14] needs amid increasing extreme weather events.

Policy and Regulatory Drivers

When China announced its 1,200GWh storage target for 2030, the market reacted overnight. Policy moves like this are accelerating adoption worldwide:

-

Renewable Portfolio Standards

30 U.S. states now require utilities to source increasing renewable percentages. -

Capacity Market Reforms

UK and EU markets now value batteries for capacity as well as energy. -

Investment Tax Credits

The U.S. Inflation Reduction Act offers 30-50% storage tax credits, even standalone systems.

Economic and Technological Factors

The business case has flipped dramatically. Five years ago, storage needed subsidies. Now, in markets like Australia and Texas, batteries are among the most profitable grid assets because they can:

- Arbitrage electricity prices (buy low, sell high)

- Provide critical grid services

- Avoid costly transmission upgrades

A recent project in New York demonstrated how a 100MW battery could defer $250 million in grid upgrades—paying for itself in under three years.

Resilience and Security Concerns

After witnessing Texas’ 2021 grid collapse, utilities worldwide are prioritizing storage for:

-

Extreme Weather Preparedness

Batteries provide backup when storms knock out traditional generation. -

Energy Independence

Countries seek to reduce reliance on imported fuels. -

Military Applications

The U.S. Department of Defense is deploying microgrids with storage at all major bases.

Regional Demand Variations

The “why” differs by region:

| Region | Primary Driver | Example Projects |

|---|---|---|

| North America | Grid resilience | Texas’ 900MW storage fleet |

| Europe | Renewable integration | UK’s 1.3GW battery pipeline |

| Asia | EV growth | China’s 200GWh EV battery plants |

Energy storage is only needed for renewable energy. False

Storage provides value across the entire energy system, including supporting traditional grids and improving power quality.

Developing countries aren’t adopting energy storage. False

Markets like India, South Africa, and Chile are experiencing rapid storage growth to address energy access and grid challenges.

Conclusion

The energy storage battery market1 is poised for exponential growth, driven by technological breakthroughs, policy support, and the global clean energy transition—with lithium-ion leading today but new chemistries shaping tomorrow.