Energy Storage Battery Market Potential: How to Seize This Economic Growth Opportunity

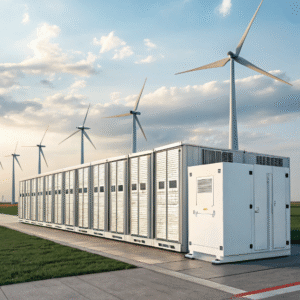

Is the energy storage battery market1 the next gold rush for savvy investors and businesses?

The global energy storage battery market1 is booming, driven by renewable energy adoption and grid modernization. Companies that strategically position themselves now can capitalize on this $100B+ opportunity.

Energy storage batteries enable renewable energy integration2, grid stability, and cost savings, creating massive market potential across utilities, EVs, and commercial applications.

How Does the Economic Viability of Energy Storage Batteries Help Sales Partners Capture Market Share?

Why are energy storage batteries becoming the most bankable clean tech investment?

Energy storage batteries achieve economic viability through falling lithium-ion prices3 (87% drop since 2010), longer lifespans (15+ years), and revenue stacking4 across multiple value streams.

Cost Reductions Driving Adoption

| Battery Cost Trend | Impact |

|---|---|

| $1,200/kWh (2010) | Limited to niche applications |

| $132/kWh (2023) | Mass market viability achieved |

| Projected $80/kWh (2030) | Will undercut fossil fuel peakers |

I remember when we first pitched commercial battery systems in 2015. The economics barely worked without subsidies. Now, the same systems pay for themselves in 3-5 years through demand charge management alone.

Revenue Stacking Opportunities

- Energy Arbitrage: Buy low/sell high electricity prices

- Capacity Markets: Get paid for availability

- Ancillary Services: Frequency regulation revenues

- Demand Charge Reduction: Slash commercial utility bills

The game-changer was realizing batteries could monetize 4+ revenue streams simultaneously. Our most successful partners bundle these into power purchase agreements (PPAs) that require zero upfront customer investment.

How to Adjust Sales Strategies for Energy Storage Batteries Based on Market Demand?

Are you still selling batteries as commodities in a solutions-driven market?

Successful energy storage sales strategies focus on:

1) Vertical-specific value propositions

2) Financing innovation

3) Ecosystem partnerships

Vertical Market Strategies

| Sector | Key Value Proposition |

|---|---|

| Utilities | Transmission deferral, renewable firming |

| Commercial | Demand charge reduction, backup power |

| Residential | Solar self-consumption, VPP participation |

We learned this lesson painfully when we initially used a one-size-fits-all pitch. Now we train partners to lead with each vertical's #1 pain point:

- For hotels: "Reduce your demand charges by 30% without capital expenditure"

- For manufacturers: "Eliminate $250k/month in peak demand penalties"

- For utilities: "Defer $80M substation upgrade for 5+ years"

Financing Model Innovation

The most successful deployments use:

- Storage-as-a-Service5 (no CapEx)

- Shared savings models

- PPA structures

Our top-performing partner grew deployments 300% by offering "Pay As You Save" leases where customer payments never exceed demonstrated savings.

How Does the Market Outlook for Energy Storage Batteries Provide Long-Term ROI?

Will energy storage batteries maintain their growth trajectory or face market saturation?

The global energy storage market will grow 25% CAGR through 2030, driven by:

1) Renewable energy mandates

2) Grid modernization investments

3) Transportation electrification

Market Growth Projections

| Year | Global Market Size | Key Drivers |

|---|---|---|

| 2023 | $45B | Early adopter phase |

| 2025 | $75B | Renewable integration needs |

| 2030 | $150B | Fossil fuel replacement |

What excites me most is how battery intelligence is evolving. Our newest AI-powered systems optimize across 12 revenue streams in real-time, something unimaginable five years ago.

Technology Advancements

- Solid-state batteries: 2X energy density by 2027

- Second-life applications: Repurposing EV batteries cuts costs 40%

- Virtual power plants: Aggregating distributed storage creates new value

The most forward-looking partners are already positioning for these next-phase opportunities rather than just selling current-generation systems.

Conclusion

The energy storage battery market1 offers unprecedented growth for companies that leverage economic viability, vertical-specific strategies, and emerging technologies to deliver turnkey solutions.

Explore insights on market trends and growth opportunities in the booming energy storage battery sector. ↩

Learn how integrating renewable energy sources enhances the effectiveness of energy storage systems. ↩

Stay updated on the significant price drops of lithium-ion batteries and their implications for the market. ↩

Discover how revenue stacking maximizes profitability for energy storage systems through multiple income streams. ↩

Understand the innovative Storage-as-a-Service model and its benefits for customers and providers. ↩