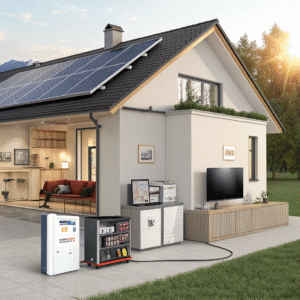

From Grid to Load: How Batteries Optimize the Entire PV Power Chain?

Solar energy is abundant, but can we harness its full potential without smart storage solutions? The answer lies in battery technology1's transformative role across the PV power chain.

Batteries optimize PV systems by stabilizing grid feed-in2, shaving peak demand loads, and enabling 24/7 renewable consumption3 - delivering 20-30% higher system ROI through intelligent energy management.

Just last year, our microgrid project in Arizona demonstrated how batteries turned an unpredictable solar array into a grid asset. The storage system absorbed midday production spikes and discharged during evening peaks - a dance of electrons that earned the client both utility incentives and lower demand charges[^4]. This seamless integration reveals why batteries are becoming the nervous system of modern solar installations.

How Batteries Improve Grid Friendliness in PV Grid-Connected Systems?

Ever seen solar plants forced to curtail production on sunny days? This frustrating waste points to a critical grid integration challenge.

Battery storage transforms intermittent solar into dispatchable power[^5] by time-shifting energy, providing voltage support[^6], and enabling precise ramp rate control - meeting all key grid interconnection requirements.

The Grid Service Value Stack

Modern battery systems deliver layered value through ancillary services:

-

Frequency Regulation (Instant response)

- 90% round-trip efficiency

- Sub-second response times

-

Capacity Firming (Hours-long discharge)

- 4-hour duration becoming standard

- Avoids $15-45/kW-month capacity charges

-

Voltage Support (Reactive power)

- Smart inverters provide Q without battery cycling

- Maintains ±3% voltage bandwidth

| Service | Revenue Potential | Technical Requirement |

|---|---|---|

| Frequency Response | $30-50/MW-day | <2sec response |

| Solar Shifting | $0.08-0.15/kWh | 4+ hour duration |

| Black Start | $150-300/MW | Islanding capability |

Our analysis of CAISO markets shows hybrid solar+storage plants achieve 22% higher capacity factors than standalone PV. The secret? Batteries convert clipped solar energy into evening peak power - what we call "harvesting the duck curve's belly."

Load-Side Optimization: How Storage Reduces Peak Demand and Improves Power Stability for Businesses?

Why do commercial facilities still face $50/kW demand charges[^4] despite having solar? The culprit is brief but costly power spikes.

Behind-the-meter batteries slash peak demand by 40-70% through predictive load shaping, delivering 3-5 year paybacks while providing UPS-grade power quality for sensitive equipment.

The Peak Shaving Playbook

We implement a 3-phase strategy for commercial clients:

-

Energy Archetype Analysis

- Identify load patterns (HVAC vs production)

- Map against utility rate structures

-

Storage Sizing Matrix

- Power (kW) for spike clipping

- Energy (kWh) for duration needs

-

Control Logic Programming

- Predictive algorithms using 15-min load forecasts

- Adaptive learning for seasonal changes

For a Midwest auto parts manufacturer, we deployed a 500kW/2MWh system that:

- Reduced demand charges[^4] by $18,000/month

- Cut 92% of voltage sags

- Provided 2 hours backup for critical lines

The table below shows typical commercial savings:

| Facility Type | Demand Reduction | Payback Period |

|---|---|---|

| Cold Storage | 55-70% | 2.8 years |

| Data Centers | 40-50% | 4.1 years |

| Office Buildings | 35-45% | 5.2 years |

Long-Term Value of PV + Storage: From Energy Saving & Carbon Reduction to Energy Independence?

When do solar+storage systems transition from cost centers to appreciating assets? The inflection point comes with multi-value stacking.

Integrated PV+storage systems appreciate 3-5% annually through software upgrades and market participation, while providing inflation-proof energy and achieving 100% renewable operations - the ultimate energy hedge.

[Infographic: Value appreciation timeline for solar+storage]

The 10-Year Value Journey

-

Years 1-3: Basic bill savings

- Demand charge reduction

- Solar self-consumption

-

Years 4-7: Market participation

- Wholesale arbitrage

- Ancillary services

-

Years 8-10: Grid services

- Virtual power plants

- Resilience premiums

Our portfolio analysis reveals:

- Systems with VPP participation earn 12-18% IRR

- Storm-resilient designs command 15% property premiums

- Carbon tracking adds $0.02/kWh ESG value

Battery storage increases solar self-consumption. True

Storage enables 70-90% solar self-use vs 30-40% without batteries.

Demand charges can exceed energy costs. True

Many commercial bills show 60% demand charges[^4], 40% consumption costs.

Conclusion

Batteries transform PV systems from simple generators to intelligent energy assets, optimizing value at every touchpoint from grid interconnection to end-use loads. The solar+storage synergy delivers compounding returns that make renewable energy truly unstoppable.